Find the best CD rates by comparing national and local rates. A Certificate of Deposit is a type of savings account that has a set interest rate and withdrawal date. Typically, CD interest rates.

The Annuity Man® has developed a proprietary tool that allows you to shop for the best MYGA rates in the country and your specific state of residence.

With our live feed of the best MYGA rates, you can now shop for annuities online to find the best annuity rate that fits your financial situation and goals before you decide to purchase an annuity.

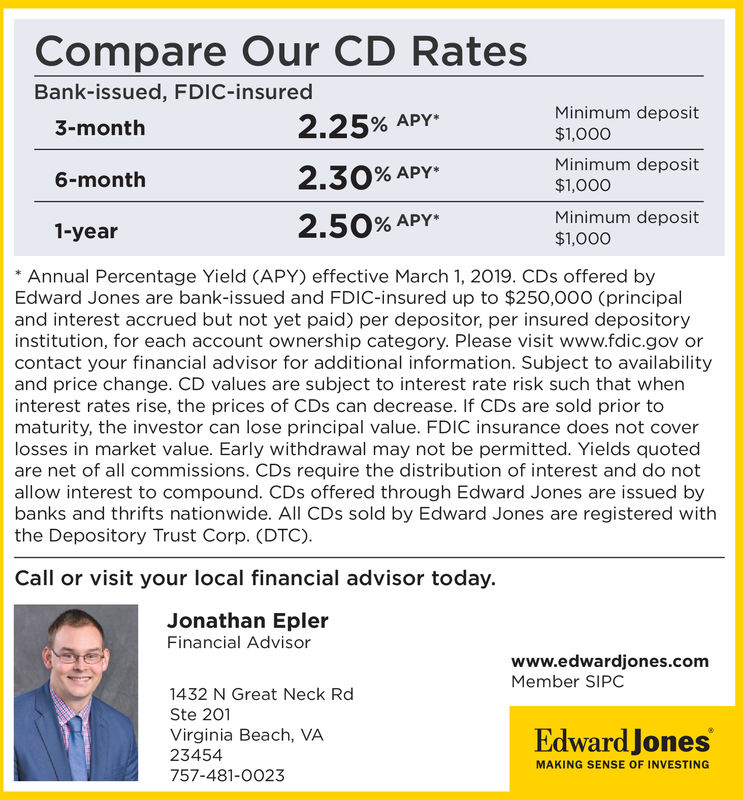

Certificates of deposit (CDs) offered by Edward Jones are bank-issued and FDIC-insured up to $250,000 (principal and interest accrued but not yet paid) per depositor, per depository institution, for each account ownership category. Best CD rates of March 2021. Bankrate has conducted market research on over 4,000 banks and credit unions nationwide to find accounts with the best CD rates. Here is Bankrate's list of top banks. Leaving Website Disclosure. This link will redirect you to a site that may have certain associated risks, including not being insured by federal deposit insurance. To remain at ou. Certificates of deposit. We know you can buy certificates of deposit (CDs) at your local bank, but Edward Jones may be an even better option. We offer very competitive interest rates, our certificates of deposit (CDs) are FDIC-insured and we have a wide selection of maturity dates and interest payment options. But unlike a bank, at Edward Jones.

Multi-Year Guarantee Annuities (MYGAs) are also called fixed-rate annuities and are a specific annuity product type that functions similarly to a CD (Certificate of Deposit).

Both MYGAs and CDs contractually guarantee an annual interest rate for a specified period, have no annual fees and are fully principal protected.

Some of the key features and benefits that MYGAs contractually offer are listed below.

- No annual fees

- Contractually guaranteed annual interest rate

- Tax-deferred growth in non-IRA accounts

- Rates are typically higher than CDs

- Interest compounds tax-deferred in a non-IRA account

- Can be purchased inside of an IRA or non-IRA account

- Easy to understand

- No moving parts or market attachments

- Can be laddered like CDs and Bonds

- Full principal protection

- Can be transferred to another MYGA without tax consequences

Multi-Year Guarantee Annuities (MYGAs) are the annuity industry’s version of a CD (Certificate of Deposit). Both MYGAs and CDs allow you to contractually lock in a specific annual interest rate for a duration of time you choose at the time of application. MYGAs can be as short term as 2 years and you can lock them in for as long as 20 years. MYGAs have no annual fees, no moving parts, and provide full principal protection while guaranteeing an annual interest rate. If you are a current CD buyer, then you should also be a MYGA buyer.

The primary difference between a MYGA (i.e. annuity contract) and a CD is that in a non-IRA (i.e. non-qualified) account, the MYGA interest grows tax-deferred with no tax penalty on the interest earned. With CDs in a non-IRA account, you must pay taxes annually on that guaranteed interest rate that is credited. This tax-deferral benefit does not make MYGAs better than CDs, it is just the primary contractual difference between the two strategies. MYGAs can also be transferred from one MYGA to another in a non-IRA account, without creating any tax consequences. In other words, that annuity to annuity transfer would be a non-taxable event using the IRS approved 1035 exchange rule. MYGAs inside of an IRA can also be transferred via a non-taxable event as well. That would be an IRA to IRA transfer and would not trigger any taxes.

After the surrender charge period ends, you can also transfer a MYGA to another type of annuity as well. For example, you can transfer the full MYGA proceeds to a SPIA (Single Premium Immediate Annuity) if you need income to start now. Another example would be to transfer your MYGA to a DIA (Deferred Income Annuity) if you need income guarantees to start at a future date. In each case, the initial cost basis would transfer to the receiving annuity strategy...and that transfer would be a non-taxable event as well.

The other difference between MYGAs and CDs is the backing or insurance behind the product. MYGAs are fixed annuities that are issued by life insurance companies and regulated at the state level. Each state has its own State Guaranty Fund that backs MYGAs to a specific dollar amount. Each state has different coverage, so go to www.nolhga.com to check your specific state of residence coverage. CDs are FDIC insured. The Federal Deposit Insurance Corporation (FDIC) is superior coverage, in my opinion, when compared to State Guaranty Funds.

MYGAs and CDs can work well together to create a fixed rate ladder strategy. Historically, we have found that MYGAs provide higher rates than CDs if the contracted term is 3 years or more. For less than 3-year time periods, CDs typically provide the highest annual rates. With most MYGAs, you can choose to peel off the interest penalty-free. Peeling off the interest is not considered “partial withdrawals” because the principal is never touched. If you do decide to dip into the principal, there will be surrender charges during the specific locked-in period. This interest only strategy can be part of your retirement income plan, in combination with Social Security, pensions, etc.

MYGAs can be set up with one owner, or with joint ownership. Also, the listed beneficiaries on the policy can be changed by the owner(s) at any time as long as they are alive. In other words, your policy beneficiaries are revocable...not irrevocable. That is important if your beneficiary listings need to be changed or updated.

If you are a current CD buyer, then you need to consider adding MYGAs to your principal protected fixed-rate portfolio. It is important to consider the MYGA company’s claims-paying ability before making your final decision. On our site, we offer a free download of a monthly CANNEX report that shows all 4 rating services (A.M. Best, Moody’s, S&P, Fitch) and an easy to understand 1 to 100 score for each life insurance company (i.e. MYGA carrier) in the United States.

Edward Jones Cd Rates And Fees

Before you purchase a MYGA, you need to read my MYGA Owner’s Manual and speak with me personally before you make a decision. We have a live feed of the best MYGA rates that you can look at and shop around without having to sign up. Most MYGAs allow you to peel off the interest penalty-free, but not ALL do. On our live feed, we will show you the MYGA carriers that allow or do not allow interest to be taken out. I encourage you to take a look at the best rates and terms for your state of residence and then schedule a call with Stan The Annuity Man® to have a full conversation about MYGAs.

There is never an urgency to buy a MYGA (or any annuity for that matter), the only urgency is to fully understand the benefits and limitations of the MYGA you are specifically considering.

Want the security of a savings account with the higher returns that investments can provide? Open a CD with BOK Financial and boost your savings today.

Let's TalkEdward Jones Cd Rates

Secure Savings and Guaranteed Interest Rates

Enjoy higher fixed interest rates with all the security of an FDIC-insured savings account. And, you can have your interest credited back into your CD or into another account related to your business, so you can reap the benefits every quarter.

Secure and Consistent

Our competitive interest rates are fixed from the day you put your money in, so your great rate is locked and you never need to wonder how much you're earning. And, most of our CDs are FDIC insured up to $250,000 — so, it's far more secure than investing in the stock market.

Interest Paid Out the Way You Want

Interest on our Certificate of Deposit accounts is compounded and paid out quarterly. You can choose to have the interest credited to your CD or deposited into another BOK Financial business account, like your checking or savings account.

Flexible Terms

We offer plenty of options when it comes to our terms, so even if you know you'll need to use your money soon, you can still take advantage of our competitive interest rates.

How to Apply

Visit one of our Banking Centers or call a Small Business Banker at (303) 864-7391 to apply. Once you've opened it, you can start using your account for all your business's needs.

Minimum Opening Deposit

:format(jpeg):mode_rgb():quality(90)/discogs-images/A-294163-1260742711.jpeg.jpg)

Monthly Fees

Who Can I Talk With?

Our Small Business Bankers are ready and waiting to discuss your business needs. You can call them at (303) 864-7391, visit one of our Banking Centers or request more information online below.

We Recommend

Small Business Resources

Building and running a successful business isn't easy, but we're with you on every step of the journey. Here are some tips and resources that might help you along the way.